Generate Interest Charges |

The Generate Interest Charges program is used to create interest charges, also known as Late Fees or Finance Charges, for customer accounts based on their outstanding balances. These instructions include Settings & Setup, Generate Interest Charges, Reporting and Invoices. Also See Generate Interest Charges Tutorial and Related Tasks.

Interest Charge Miscellaneous Transaction Code

Note: Miscellaneous Transaction Code for Interest Charges is necessary prior to generating interest.

Navigate To: System>Configuration>Code Maintenance>Accounting>Miscellaneous Transactions

- Enter two-digit code.

- Enter Description for Interest Charge. (Interest, Finance Charge, Late Fee, etc...).

- Save.

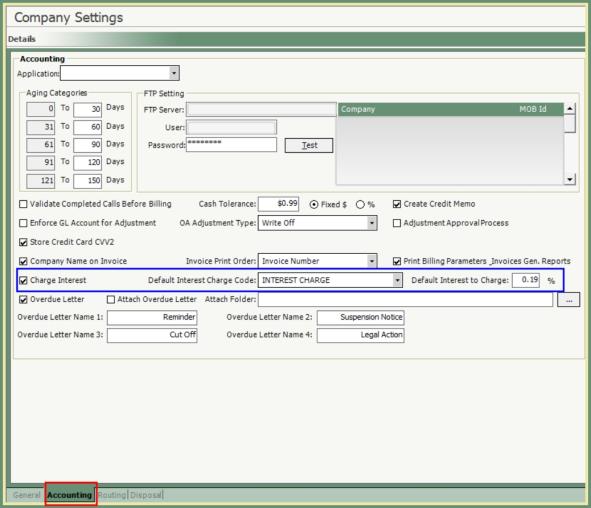

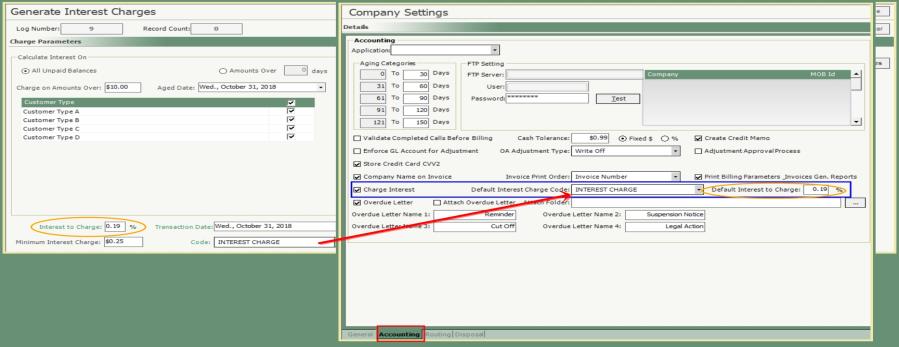

Default Interest Settings in Company Settings

Navigate To: System>Administration>Company Settings>Accounting

- Check the Charge Interest box.

- When the Charge Interest flag is set then any new customer that is added will have the CHARGE INTEREST flag automatically set.

- Select Default Interest Charge Code from the drop down.

- Enter Default Interest to Charge ____ %.

- Save.

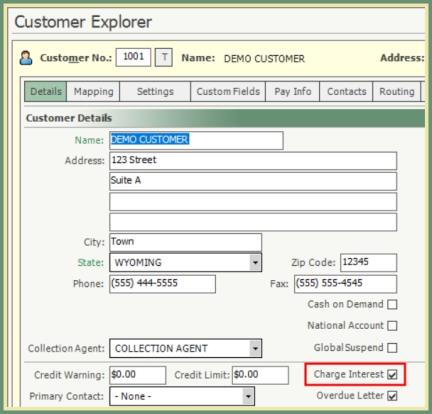

Customer Explorer Charge Interest Setting

Navigate To: Customers>Customer Explorer

- Check the Charge Interest box.

- Save.

- When the Charge Interest flag is set then any new customer that is added will have the CHARGE INTEREST flag automatically set.

- Setting the Charge Interest flag will need to be set manually for existing customers to be included in potential interest charges on unpaid balances.

- If Charge Interest is unchecked, the customer will be excluded from any interest charges on unpaid balances.

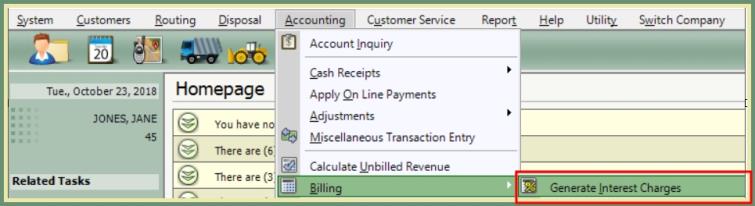

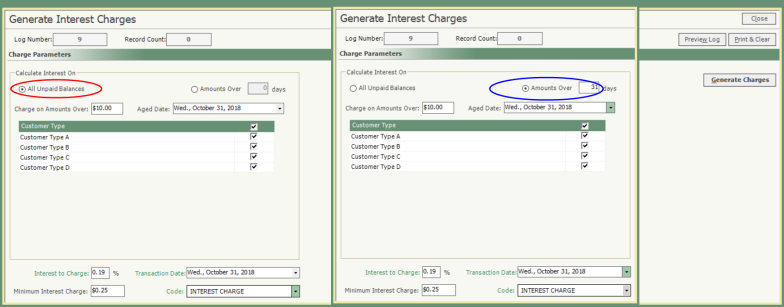

Navigate To: Accounting>Billing>Generate Interest Charges

- Select All Unpaid Balances or Amounts over ___ days.

- Enter an Amount in Charge on Amounts Over ____.

- This is the amount of unpaid balances per account.

- Example: If the Charge on Amounts Over $10.00, then balances less than $10.00 will not receive an Interest Charge.

- Select Aged Date. Interest will generate based on unpaid balances as of the Aged Date selected.

- Select the Customer Types to include or exclude from the Interest Charge calculations.

- Interest to Charge will default based on Company Settings, or enter percentage manually.

- Transaction Date. The date that will be used on the Miscellaneous Transaction and included on the invoice.

-

Transaction Date should be on or before the next expected Invoice Date.

- Enter Minimum Interest Charge amount. Interest Charges will not generate less than this amount.

- Example: If the Minimum Interest Charge is set to $0.25, then interest charges will not be generated for less than $0.25.

- Code will default based on the Company Settings, or select from the drop down. This is the miscellaneous transaction code description that will print on the customer invoice with the Interest Charge.

- Click Generate Charges.

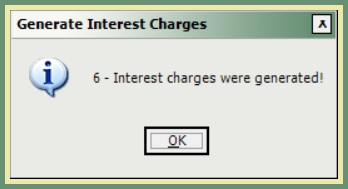

- Count of Interest Charges Generated will be indicated, click OK.

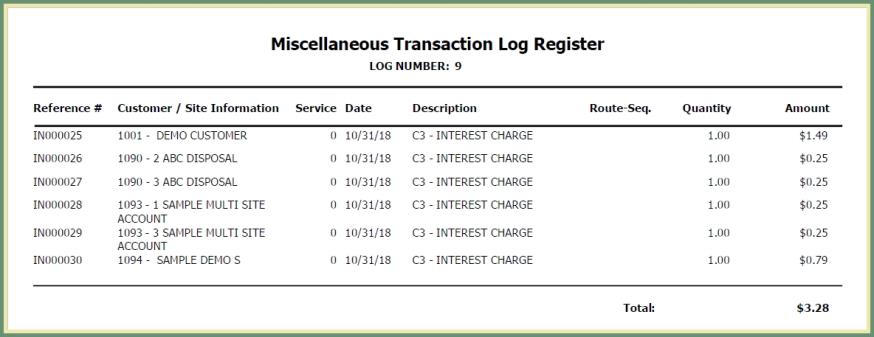

- Print & Clear Log.

- Interest Charges generated will be included on the Miscellaneous Transaction Log.

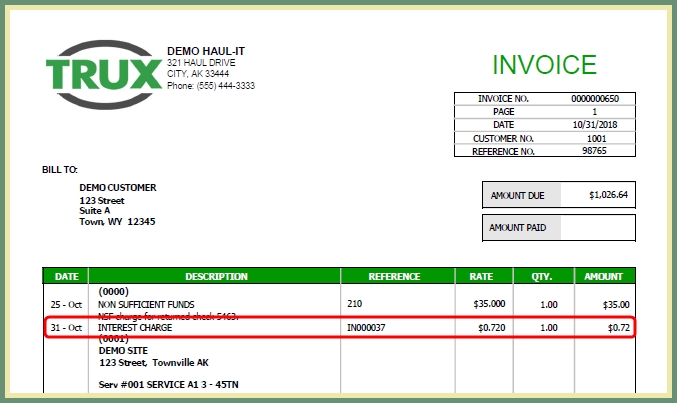

- Miscellaneous Transaction reference numbers will be prefixed with IN followed by the next sequential number.

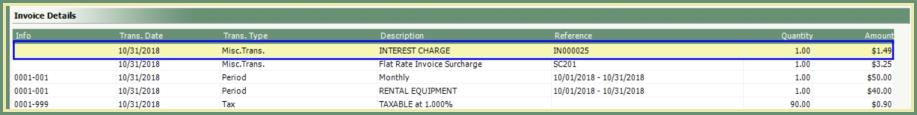

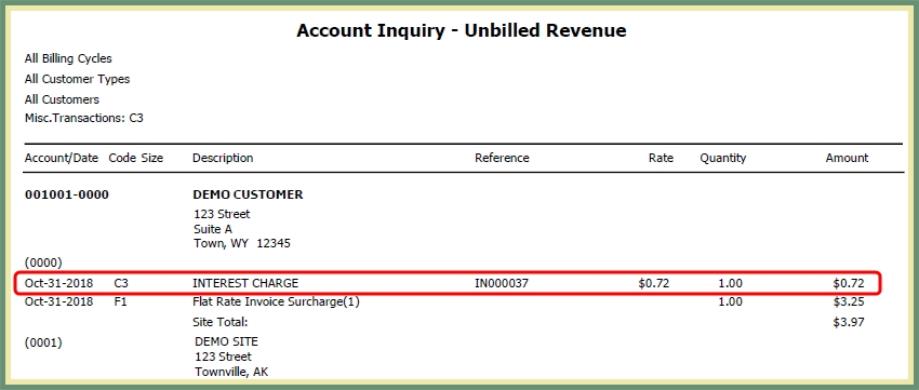

- Interest Charge is immediately available on the customer account in Account Inquiry Invoice Details in unbilled or billed status.

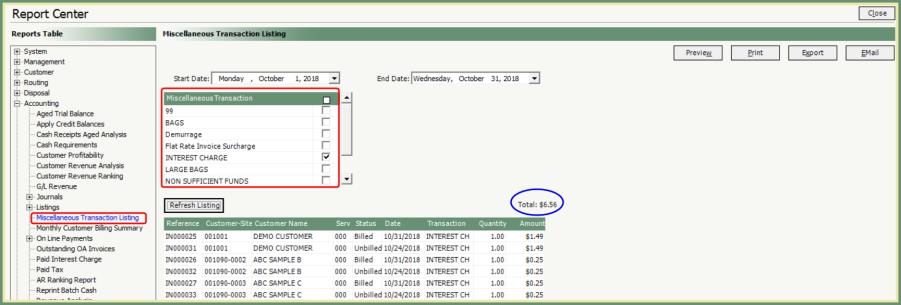

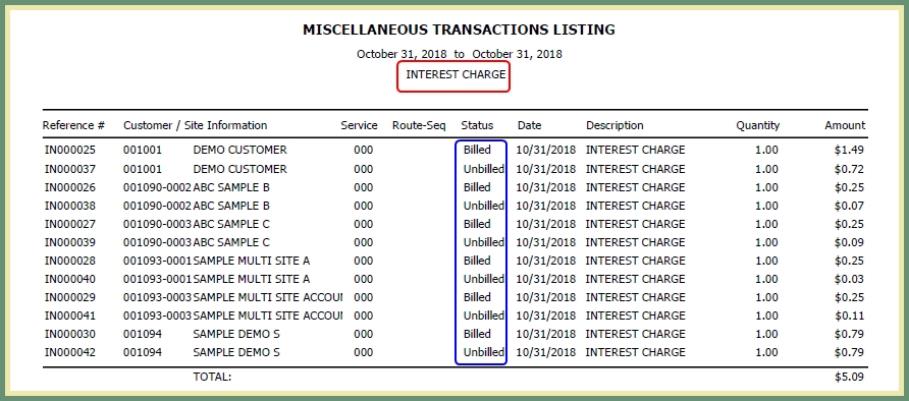

Miscellaneous Transaction Listing for Interest Charges Only

Navigate To: Report>Report Center>Accounting>Miscellaneous Transaction Listing

- Select start and end dates to report.

- Select the miscellaneous transaction code used for Interest Charges.

- Grid will include the include the miscellaneous transactions based on the parameters above.

- Click Refresh following any changes to the parameters.

- Total will summarize a total of the miscellaneous transactions in the grid.

- Select output to generate the Miscellaneous Transaction Listing.

- Reference # for interest charges are prefixed with the letters IN.

- Status will indicate if the interest charge is Billed or Unbilled.

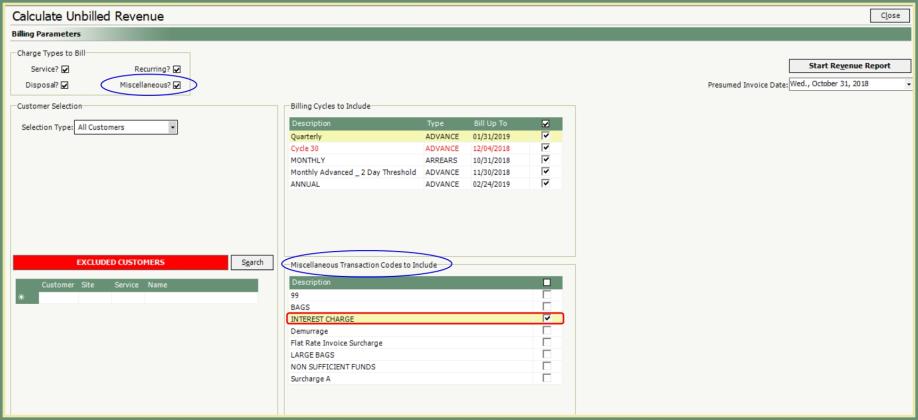

Navigate To: Accounting>Calculate Unbilled Revenue

- Enter Billing Parameters to be included on the Unbilled Revenue.

- Miscellaneous must be checked in Charge Types to Bill to include Interest Charges.

- Select the Miscellaneous Transaction Code for Interest Charges to Include. (Additional codes can be included if necessary).

- Select Presumed Invoice Date inclusive of the Interest Charges generated.

- Click Start Revenue Report.

- Generate invoices as usual.

- Include Miscellaneous Transactions in Charge Types to Bill.

- Include the Interest Charges Miscellaneous Transaction in the billing parameters.

- Miscellaneous Transaction Interest Charge Description, Reference and Amount are included on the customer Invoice.